Online Banking

VISA Account

Existing users do NOT re-enroll. Contact us

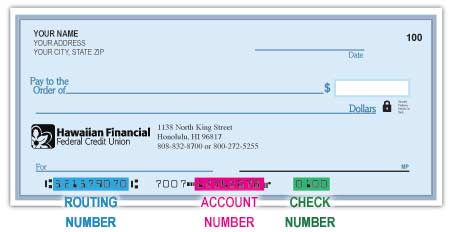

Routing # 321379070

Existing users do NOT re-enroll. Contact us

Routing # 321379070

There are approximately 13,500 member-owned cooperative financial institutions, known as credit unions, in the U.S. Their roots go back to 1849 when the first credit union was established. It began amidst the poverty of the mid 1800's in Germany. The Mayor at that time encouraged farmers to pool their money and make loans to each other rather than borrow from moneylenders. This concept spread to Canada and the U.S. in the early 1900's. Edward Filene is the father of the American credit union movement.

In April 1936, six teachers on the Big Island pooled their deposits totaling $30 to organize the first credit union in Hawaii. The Big Island Educational Federal Credit Union was chartered in August 1936. Hawaiian Financial Federal Credit Union (formerly called Hawaiian Tel Federal Credit Union) was the first credit union chartered on Oahu. On the same day in October 1936, Hawaii Territorial Employees' Federal Credit Union (now called Hawaii State Employees' Federal Credit Union) also signed their charter.

The Hawaii Credit Union Act was signed into law by Governor John A. Burns on May 29, 1973.

Hawaiian Financial Federal Credit Union's primary field of membership shall be limited to those having the following common bond:

If you have a question regarding an eligible company, please call New Accounts at (808) 832-8700 / 1(800) 272-5255 or Sales at (808) 832-8731.

The National Credit Union Administration (NCUA) is the federal agency that administers the National Credit Union Share Insurance Fund (NCUSIF). The NCUSIF, like the FDIC's Deposit Insurance Fund, is a federal insurance fund backed by the full faith and credit of the U.S. Government.

The NCUSIF insures member savings in federally insured credit unions, which account for approximately 98 percent of all credit unions. All federal credit unions and the vast majority of state-chartered credit unions are covered by NCUSIF insurance protection.

Credit unions that are insured by NCUSIF must prominently display the official NCUA insurance sign. No credit union may terminate its federal insurance without first notifying its members.

Here are some important facts to remember about your share insurance provided by the NCUSIF:

Routing Number: 321379070

Please call Card Services at 1-833-681-3523 to reset your PIN. When calling you must know your existing PIN. If you do not have your PIN, please call our Clearing Department at 808-832-8700 to request a new PIN. Please note that there is a $1 fee to request a new PIN number. There is no fee to change an existing number.

For outgoing wires we charge $35.00 for domestic and $40 for international. Outgoing wires must be done in person and received by 9:00am. All wires received after 9:00am will be sent the following business day.

Incoming Wire Instructions:

CREDIT: Hawaiian Financial Federal Credit Union, 1138 N. King Street, Honolulu HI; ABA# 3213-7907-0;

FINAL CREDIT: (Members Name); Account Number-subaccount.

There is a daily limit of $400.00 per day on all ATM transactions.

There could be several reasons as to why your account may not be working. Your account could be locked from too many unsuccessful attempts, you registered your computer and are using another computer, or other similar situations. You may attempt to reset your password to gain access. Fill in your USER ID, answer your question and when prompted to put in your password - STOP! Scroll below the answer box where it says RESET PASSWORD. Click it and fill out the questions. It will ask for your social security number, name as it appears on your statement, and your birth date. If you use a middle name or initial on your account, please make sure you write it correctly. If all information is provided correctly, you will be prompted to put in a new password. Please remember that passwords must include a number, special character, upper and lower case and between 8-12 characters. After resetting your password, you will be asked to log in again.

Yes, Hawaiian Financial Federal Credit Union offers FREE Notary services to its members. You must call and make an appointment at the branch you wish to visit. Hawaiian Financial Federal Credit Union will not be an attested witness. Non-members are charged a fee.

After your VISA card is approved. It will take approximately two weeks to receive your card.

It will take approximately two weeks to receive your card.

You may transfer money to any account from an account that you own when you are doing the transaction in person. You will not get a balance or history on that account, but you will receive a counter receipt. You can do transfers to accounts that you own through online banking if you link the accounts in person at one of our branches. You can do transfers within your account number, such as savings to checking through our Anytime Teller 24/7 voice response system, phone tellers, and online banking.

As a courtesy, we ask that if you plan on making a large withdrawal that you call the branch you intend to visit. You may withdraw all available funds in your account providing we have the cash on hand. Checks can be cut for any amount without prior notice.

Cashier's checks are checks drawn directly from the institution's account. Cashier's checks are considered the same as cash because the funds are from the bank itself. Some retailers may require cashier's checks if mandatory payments need to be made, a large sum in exchange for goods or long distance payments. Cashier's checks are available at the credit union. First cashier's check is free, subsequent cashier's checks are $5.00 per check on a daily basis. If you need to to stop payment on a cashier's check, you will need to fill out the proper forms and there is a $20.00 per item fee. For additional information, please call 808-832-8700.

On the accounts at the Credit Union we have suffix numbers to identify sub-accounts. For example, if your main account number is 1111, a suffix would be added to each account you have. Regular savings would be 1111-01, Christmas would be 1111-25, Regular checking would be 1111-70 or 1111-75. All loans would have suffix numbers as well. However, loan suffix numbers are based on sequence and type, making the variations too vast to list here. Please call 808-832-8700 for more info.

Yes, Hawaiian Financial Federal Credit Union provides online bill payments to its members who have checking accounts. At this time the service is free.

We are happy to announce the return of the Hawaiian Financial Federal Credit Union Scholarship Program. Complete Scholarship Details.

A NSF is an acronym for non-sufficient funds. If you overdraw your checking account and you have an established Overdraft Protection and the amount is not greater than your available balance, there will be no fee for accessing your Overdraft Protection. You will be charged interest (like a loan) for the period that you have an outstanding balance. If you overdraw a check and do not have Overdraft Protection but qualify for our Courtesy Overdraft Protection Plan, the plan may cover the overdrawn amount and you will be charged the NSF fee. For a list of fees please refer to our Rate and Fee Schedule.

Courtesy Pay is the name of our program that pays overdrafts if you qualify for the program. Please read our Courtesy Draft brochure.

Experian is one of the major credit bureaus that keep track of your credit history and provides insight on the ability to make good on a loan.

Although we would like you to keep your account, we understand that sometimes closing is necessary. You may close your account by coming into any branch and by mail. When closing by mail, please indicate your name, SS#, and account numbers of the account you would like to close. Also include instructions on what and where you would like us to do with the remaining funds (if applicable) and a current, valid phone number in case we have any questions. Finally, sign your request so we may validate your signature. Please mail to: Hawaiian Financial Federal Credit Union, 1138 N. King Street, Honolulu, HI 96817.

Sharedrafts are also named checks. Hawaiian Financial Federal Credit Union offers its members FREE Sharedrafts if they meet the following criteria: First sharedraft order, eligible for Pioneers Club, or have direct deposit of $200+ per pay period.

The Credit Union no longer provides forms to our members. Both State and Federal forms that were available to us are offered online by the respective agencies. During Tax season (January - April) we offer a direct link with discounts on our website to TurboTax.

If you would like to have a joint VISA card where both card holders are responsible and liable for the payments, you will need to fill out a VISA application to add the person to your account. The VISA department may be reached at 808-832-8737 or emailed at VISA@hificu.com.

If you need your VISA, Debit or ATM card rushed - we can make the request. Fees may be charged for shipping and cards could arrive 3-5 days. Please call 808-832-8700 for details.